Getting into a car accident can be stressful, especially when you’re unsure about the steps to take next. If you find yourself in Saudi Arabia experiencing this unfortunate event, knowing the proper procedure after accident is crucial to ensure safety, legal compliance, and a smooth insurance claim process. This guide breaks down every essential step—from immediate actions at the scene to submitting your insurance claim—so you can handle the situation confidently and efficiently.

Table of Contents

- 📸 Step 1: Ensure Safety and Take Damage Pictures

- 📞 Step 2: Contact Emergency and Police Services

- 📱 Step 3: Prepare Your Mobile Apps and Documents

- 📩 Step 4: Share Information with the Officer

- 📩 Step 5: Receive and Review the Post-Accident Process Message

- 🏢 Step 6: Book an Appointment at the Taqdeer Office for Cost Estimation

- ⏳ Step 7: Wait for the Damage Assessment Report from Taqdeer

- 🔍 Step 8: Identify the Other Party’s Insurance Company

- 📝 Step 9: Submit Your Insurance Claim

- 💳 Step 10: Choose Your Payment Method for Claim Settlement

- ⏳ Step 11: Track Your Claim Progress and Receive Settlement

- ❓ FAQ: Common Questions about Procedure after Accident in Saudi Arabia

📸 Step 1: Ensure Safety and Document the Scene

The moment an accident occurs, the first priority is to check if all passengers are safe and unharmed. Once safety is confirmed, the next critical step is to capture clear photos of the accident scene. These photos should include the damaged parts of all vehicles involved, the surrounding environment, and any relevant road signs or signals.

Taking detailed pictures right away is important as they serve as vital evidence for both police reports and insurance claims. If possible, take photos from multiple angles to show the extent of the damage clearly.

📞 Step 2: Contact Emergency and Police Services

After documenting the accident, immediately call the official Saudi emergency number 199033. This call alerts the authorities who will dispatch a police officer to the scene. The police officer’s role is to assess the situation, ensure safety, and begin the formal accident reporting process.

It’s important to stay calm and provide accurate information about the accident location and the condition of everyone involved.

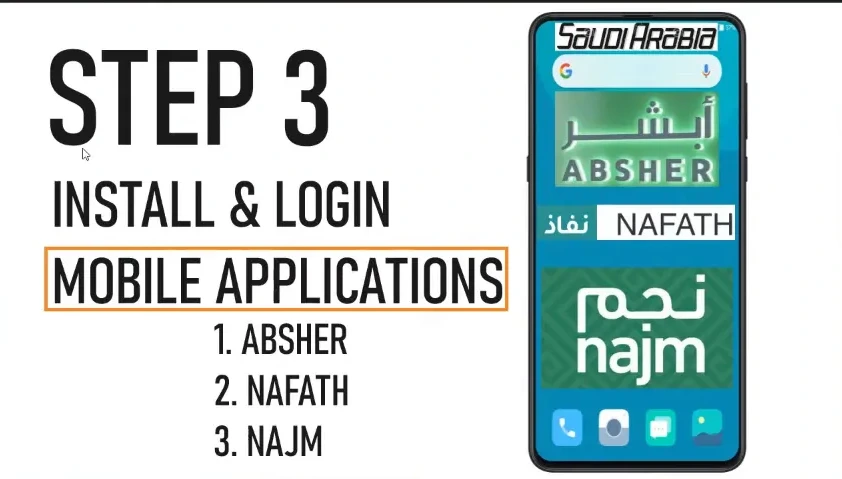

📱 Step 3: Prepare Your Mobile Apps and Documents

While waiting for the police officer, ensure you have a stable internet connection and have the three essential mobile applications installed on your phone. These are required for accident reporting and insurance claims. They Include

- Absher

- Nafath

- Najm

After installing, log in to these apps using your credentials.

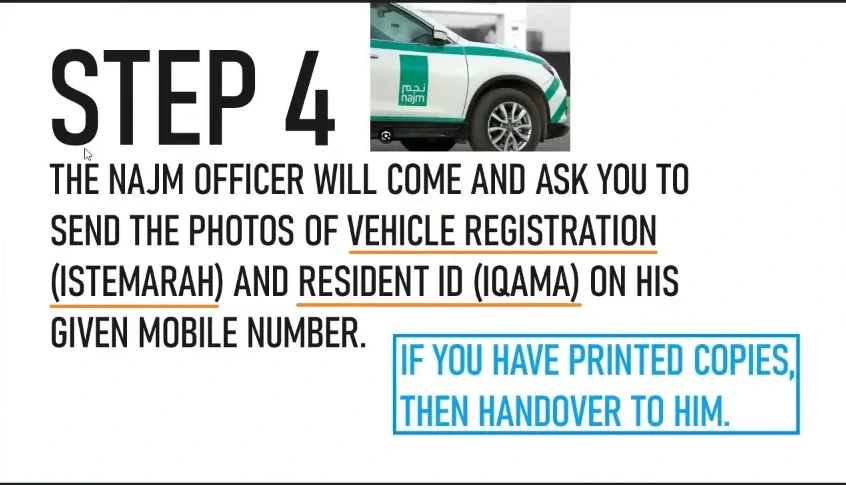

📩 Step 4: Share Information with the Officer

The police officer will request you to send photos of the following documents via the app or directly to their provided mobile number:

- Vehicle Registration

- Insurance Card (Isara)

- Resident ID (Iqama)

If you have printed copies, hand these over to the police officer for verification.

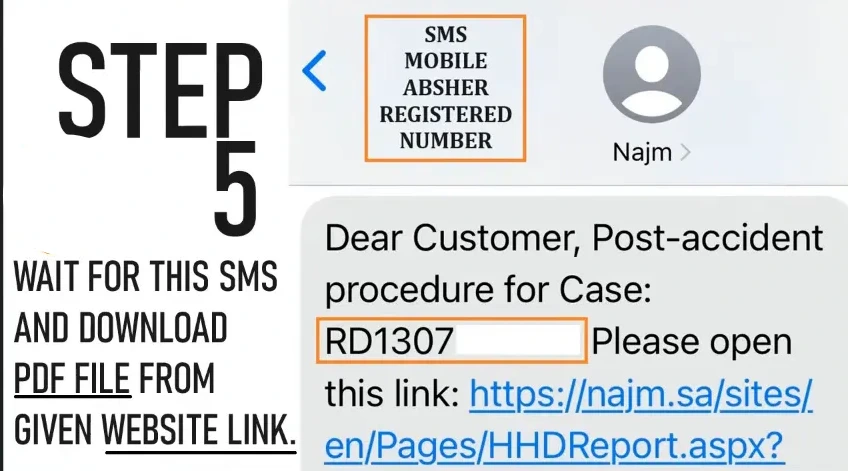

📩 Step 5: Receive and Review the Post-Accident Process Message

Once the police complete their initial report, you will receive an SMS containing your case number and a link to a PDF file detailing the accident report. This PDF document is a critical piece of your claim process. It includes:

- A summary of the accident

- Visual identification of new damages (marked with a cross)

- Pre-existing damages (marked with circles)

Review this document carefully to ensure all damages are correctly noted before moving forward.

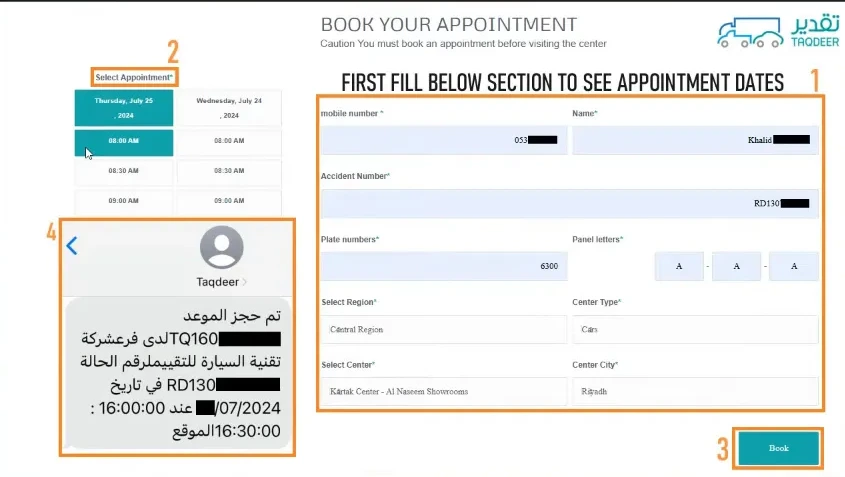

🏢 Step 6: Book an Appointment at the Taqdeer Office for Cost Estimation

The Taqdeer office is a government-registered entity responsible for estimating repair costs after an accident. Booking an appointment here is mandatory to obtain an official damage and cost assessment, which you will submit to the insurance company.

To book your appointment, follow these steps:

- Visit https://taqdeer.sa

- Fill in your personal details

- Enter the accident case number received in the SMS.

- Provide your vehicle’s plate letters and numbers.

- Select your vehicle type (car, truck, etc.).

- Choose your region and preferred Taqdeer center (for example, Riyadh).

- Select an available date and time slot from the calendar.

- Confirm your booking and wait for the confirmation SMS from Taqdeer.

You can locate the Taqdeer office easily using Google Maps by searching for “Taqdeer” or “تقدير”

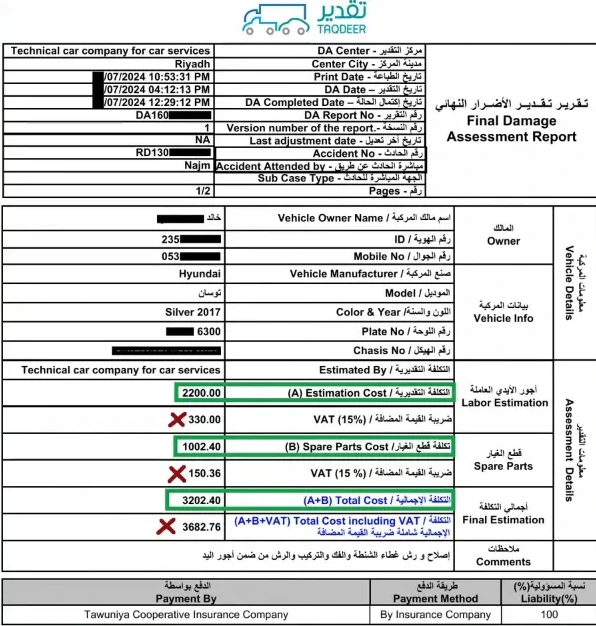

⏳ Step 7: Wait for the Damage Assessment Report from Taqdeer

After your appointment, it typically takes 24 working hours (excluding Friday and Saturday, which are weekends in Saudi Arabia) to receive the damage assessment report. This report breaks down the estimated costs into two main categories:

- Labor Costs (Section A)

- Spare Parts Costs (Section B)

The total estimated repair cost equals the sum of these two parts, excluding VAT.

You can view this damage assessment report on the mobile app by navigating to the dashboard, scrolling down, and selecting “View Damage Assessment.” Here you’ll find details such as:

- Your insurance company’s name

- Your personal details and policy information

- Accident number and liability percentage (0%, 25%, 50%, 75%, or 100%)

- Damage assessment number and estimated repair amount

For example, a 0% liability means you are not responsible for the accident.

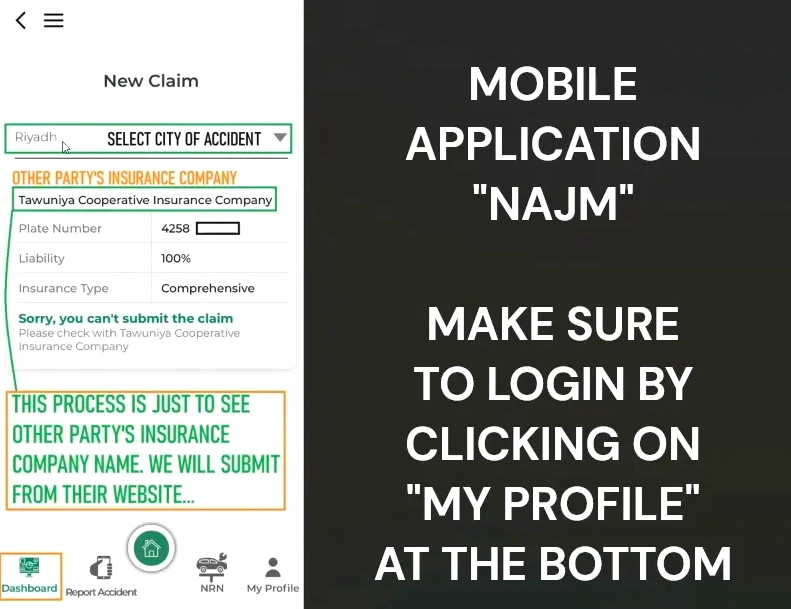

🔍 Step 8: Identify the Other Party’s Insurance Company

Knowing the other party’s insurance provider is essential for submitting your claim. To find this information, open the accident reporting app again and:

- Go to “My Profile” to confirm you are logged in.

- Navigate to the dashboard and scroll to the bottom.

- Select “New Claim.”

- Choose the city where the accident occurred.

The app will display the other party’s insurance company name and their vehicle’s plate number. It will also show the liability percentage attributed to the other party—often 100% if they caused the accident.

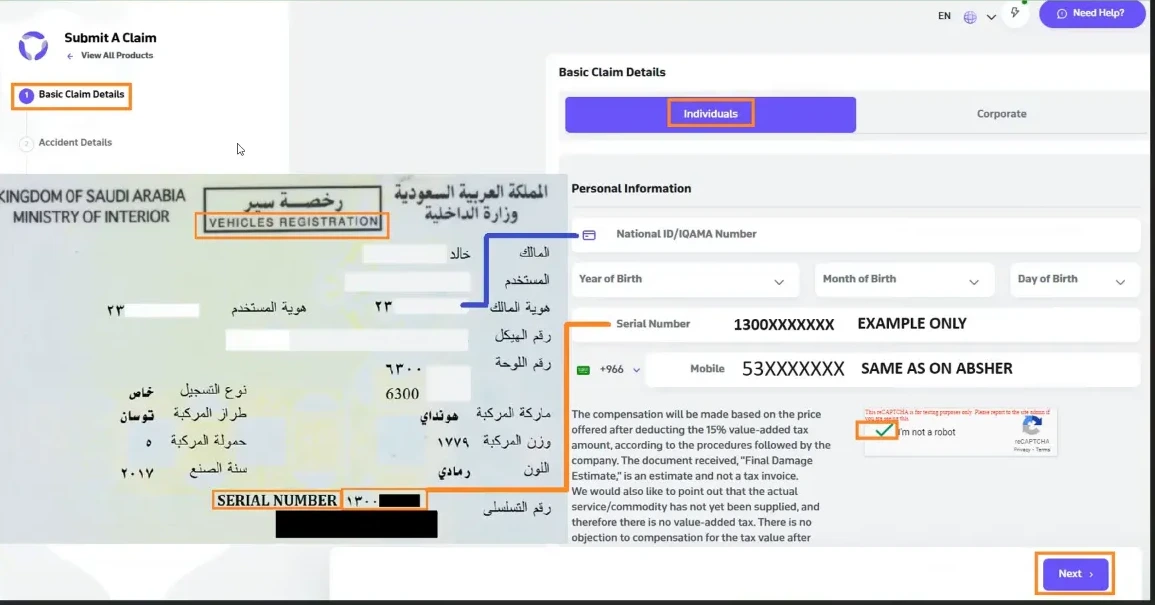

📝 Step 9: Submit Your Insurance Claim

Once you have the other party’s insurance company name, search for their official website to submit your claim. The claim submission process generally involves:

- Visiting other party’s official insurance website.

- Choosing the “Motor” insurance claim section.

- Clicking on “Submit a Claim” and selecting “Individuals.”

- Filling in your personal information including your Iqama number, date of birth, vehicle registration serial number, and mobile number.

- Choosing the accident source (e.g., Najm application).

- Entering the accident number and retrieving accident data.

- Uploading scanned copies of your vehicle registration

- Uploading the Taqdeer damage assessment document.

When uploading the vehicle registration, if the serial number is in Arabic, seek help from someone who can translate it to ensure accuracy.

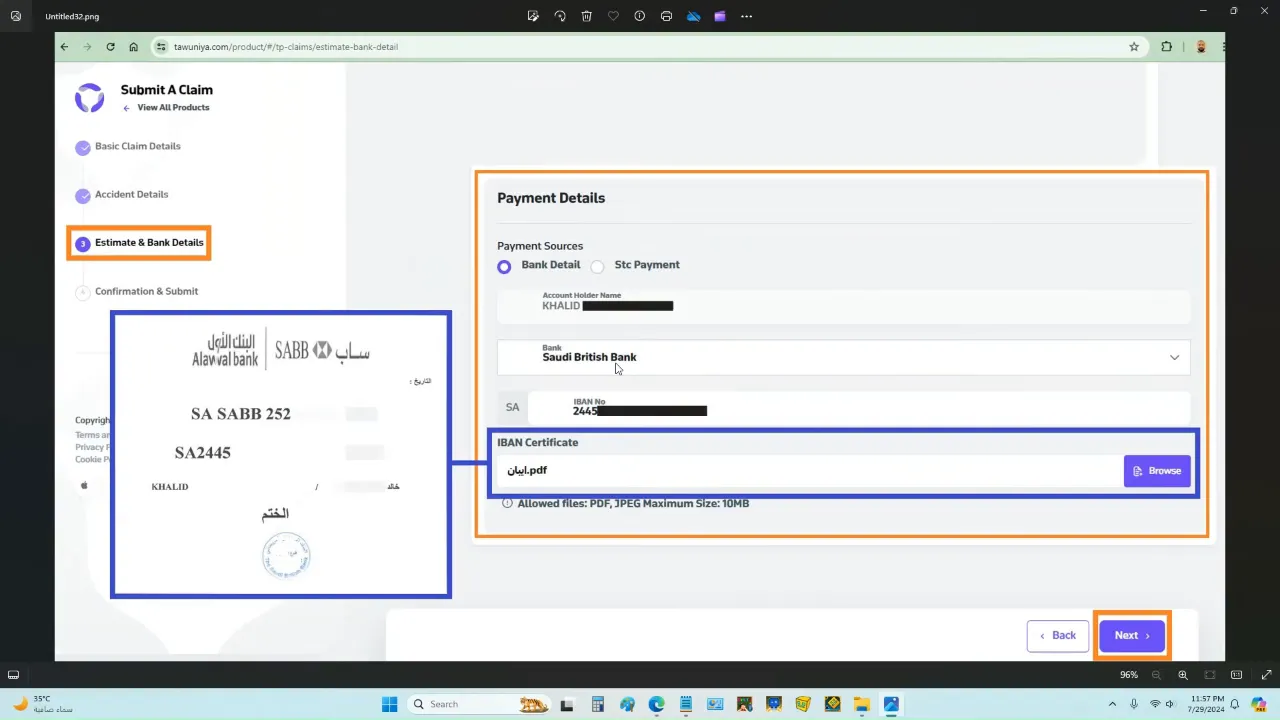

💳 Step 10: Choose Your Payment Method for Claim Settlement

For receiving your insurance settlement, you have two main payment options:

- Bank Transfer: Enter your bank name, IBAN number, and upload your IBAN certificate. This certificate can be obtained from your bank branch or online banking portal and is valid for up to one year.

- STC Pay or Other Wallet Apps: Use this mobile payment method by entering your mobile number. Verify it through the STC Pay/Other Wallet app, then submit.

After submitting, you will receive a reference number confirming your claim has been registered. You can track the status of your claim after 24 hours.

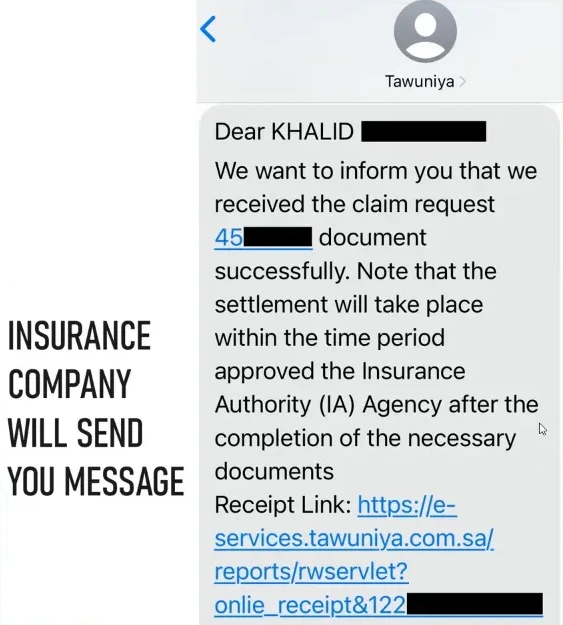

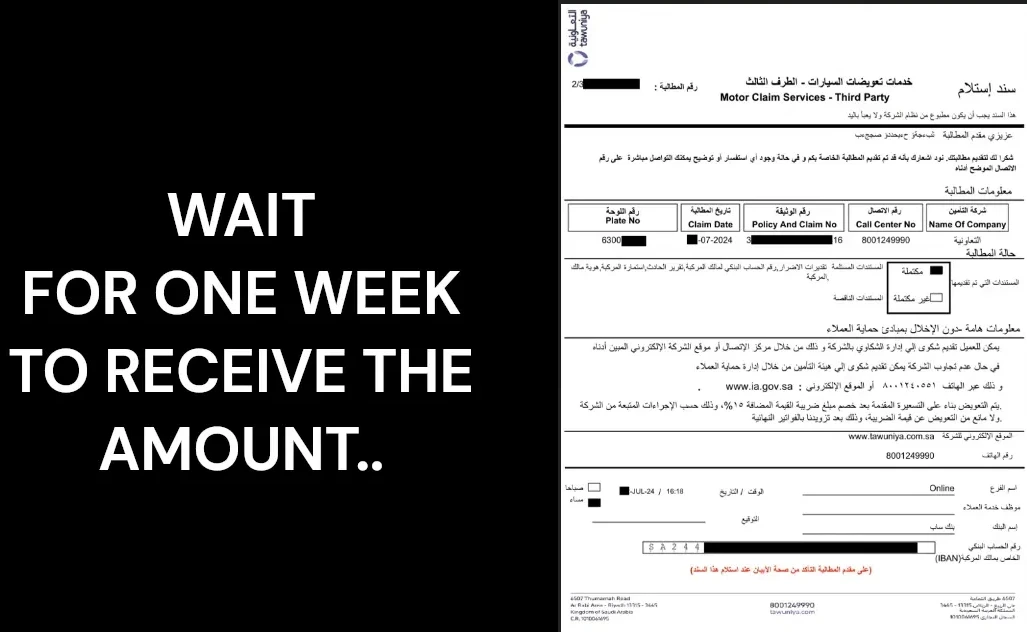

⏳ Step 11: Track Your Claim Progress and Receive Settlement

The insurance company usually processes your claim within one to two working days, excluding weekends (Friday and Saturday). Once your claim is processed, you will receive a message confirming your request is under review.

A link will be provided to download the receipt, which includes your banking details and payment information. Keep this receipt safe for your records.

Typically, it takes at least one week to receive the full settlement amount, depending on the insurance company’s internal procedures.

❓ FAQ: Common Questions about Procedure after Accident in Saudi Arabia

What should I do immediately after an accident?

First, check for injuries and ensure everyone’s safety. Then take photos of the accident, call emergency services at 199033, and wait for the police to arrive.

How do I book an appointment at the Taqdeer office?

Use the online booking system by entering your personal details, accident number, vehicle information, and selecting your preferred date and time at a nearby Taqdeer center.

What documents do I need to upload for my insurance claim?

You must upload your vehicle registration card, the Taqdeer damage assessment report, and any other requested documents in PDF or JPEG formats.

How long does the insurance claim process take?

The claim processing usually takes one to two working days after submission, with the entire settlement process possibly taking up to one week.

Can I track the status of my insurance claim?

Yes, after submitting your claim, you will receive a reference number to track your case via the insurance company’s website or app.

By following these clear steps and keeping all necessary documents ready, you can manage the post-accident process efficiently and get back on the road with confidence.