As the deadline to link Aadhar card and PAN card for non residential Indians in Saudi Arabia is getting close, Indian Expats in Saudi Arabia must take care to ensure that their Aadhar and PAN documents are linked to avoid any potential penalty. In this guide, we have detailed the simple 5 minute process to link PAN with Aadhar card.

What is PAN Card and Aadhar Card?

PAN (Permanent Account Number) is a 10-character alphanumeric identifier issued by India’s Income Tax (IT) department to assess tax liabilities of individuals and entities who have income in the country.

While Aadhaar Card is a unique 12-digit identification number issued by the Unique Identification Authority of India (UIDAI) to all residents.

Why is the Indian government insisting on linking the two documents?

The new system that links an Aadhaar card with a PAN will remove biases and unify the country as one territory for tax assessing purposes, giving assessing officers to examine I-T records of resident Indians irrespective of where they stay in India.

How to link a PAN and Aadhaar card?

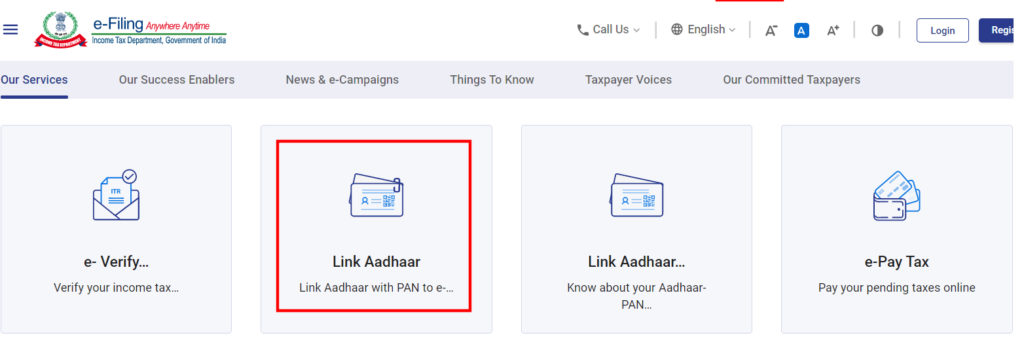

1- Log on to http://www.incometaxindiaefiling.gov.in/home

2- Click on ‘Link Aadhaar’ under Our Services Section section

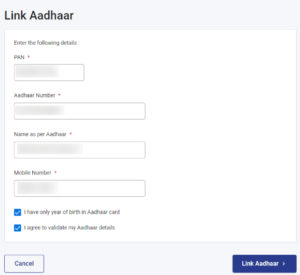

3- Enter details such as PAN card, Aadhaar card, Name

4- Click on the ‘Link Aadhaar’ option at the bottom of the page

What is the Deadline for Linking of PAN with Aadhaar card?

The latest deadline to Link PAN and Aadhar card is 30 September 2021.

What if I don’t link PAN and Aadhaar Card?

Indians who fail to link the two numbers would be liable to pay a penalty of INR 1,000 ( SAR 50), according to the Finance Bill 2021.

Source